Wage & Salary | Continuing education | DATEV/Lexware | Course | Specialist degree | rehab

Wage & salary training with DATEV/Lexware – Professional Courses

Would you like to continue your commercial education and qualify for a specific economic sector? We from Central German Institute offer you a flexible solution with which you can design your further training path individually! With our Commercial modular qualification (KMQ) we offer you a wide range of professional training opportunities in the commercial sector. Here you can acquire the qualifications you need for your goals and career plans.

The module Specialist for wage and salary accounting with DATEV/Lexware enables you to acquire an important additional qualification in the commercial field of accounting as an office worker, clerk, returnee and career starter. In a combination of theoretical knowledge transfer as well as practical and computer-aided application exercises, you will be trained to correctly carry out the complex processes of payroll accounting using payroll accounting software. Lexware and DATEV are the programs most used by companies. Therefore, as a successful graduate of this further training measure, you will be of interest to employers from various sectors. Equipped with application knowledge of the most popular accounting programs and with a professional qualification, you will increase your potential and chances of success on the job market.

If you would like to find out more about the wage and salary accounting module with Lexware/DATEV, then contact us now! You can reach us via our inquiry form or by telephone on 0800 77 89 100.

Important information about the module

Measure objective: Carrying out correct payroll accounting using accounting software

Duration: 3 months

Started: individually by arrangement

Form of teaching:

computer-aided learning on the premises of the MIQR in the presence of a lecturer

+ additional consultations with specialist lecturer

Lesson time: theoretical lessons from 8 a.m. full-time

Verifiable: Approval via DRV

Certificate: Specialist in payroll accounting

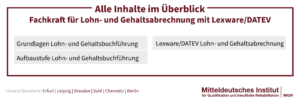

Contents:

- Payroll accounting

- Advanced course in payroll accounting

- Lexware or DATEV wages and salaries

Objectives of the Payroll Specialist module

The aim of this measure is to give the participants knowledge of income tax and social security law mediate in order to enable them to do their own wage and salary accounting.

The Processing of practical cases the participants are informed about new regulations and also learn how to put them into practice. In addition, they will Application of computer-aided billing programs trained. At the end of the training, the participants should have a comprehensive understanding of the income tax and social security regulations as well as the accounting work processes.

Target group of the wage and salary specialist module

The training is aimed at customers of the German pension insurance who are interested in business and oriented towards it, job seekers with particular placement obstacles and people undergoing rehabilitation or those seeking professional help who have opted for a specialist qualification in the commercial field.

Specifically, the measure is aimed at people who

- strive for an individual new or re-entry through commercial training with qualification

- Want to build and expand knowledge

- aim at a modular qualification in the commercial area.

The module Specialist in payroll accounting with DATEV/Lexware is suitable for those who already have commercial experience and would like to specialize in the wage/salary department. Thanks to the modular structure of the KMQ, returnees and career starters also have the opportunity to acquire a professional qualification in the field of payroll accounting. In this way, you can succeed in individually starting or re-entering the commercial sector.

entry requirements

The participants in the module Specialist in payroll accounting should, in addition to commitment and willingness to learn, as well as a general understanding of numbers

- at least a high school diploma,

- completed vocational training or

- several years of work experience

feature.

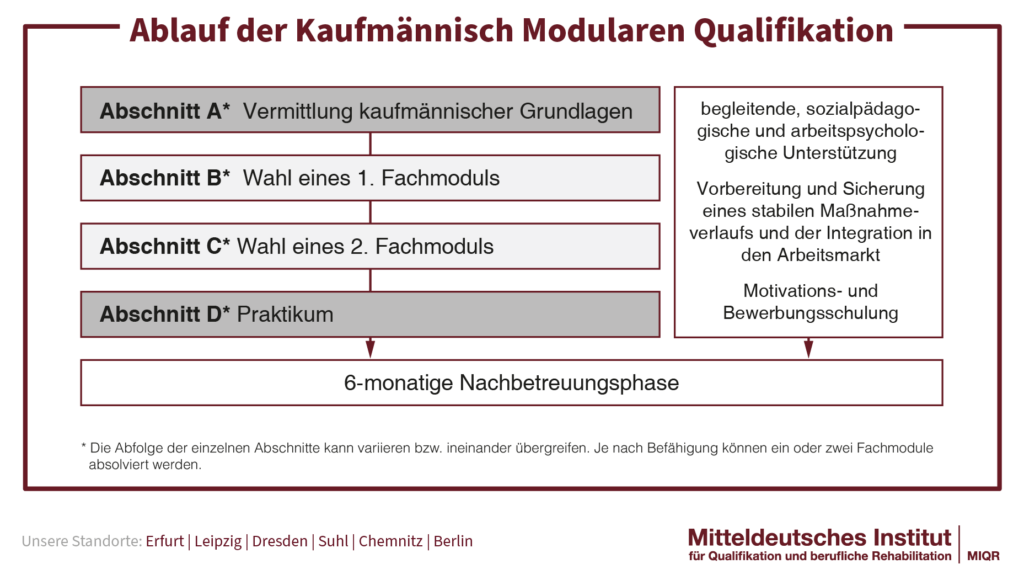

Process of the commercial modular qualification

Thuringia and Saxony:

The measure has a duration of 9 months and an optional 6-month follow-up period. At the beginning, all participants go through a subject test and work-related introduction. The training and qualification phase takes place depending on these results. The participants now have the opportunity to start with the commercial basics (Section A) and are then trained in one or two selected qualifications (Sections B and C) from the 10 modules offered, depending on their ability and level of performance. This is followed by the orientation and work-related internship (Section D).

Berlin:

For our Berlin participants, the commercial modular qualification covers a period of 12 months and an optional 6-month follow-up period.

At the beginning of the measure, all participants go through a subject test and work-related introduction. Depending on the results, they then begin their training and qualification phase. This combines content on commercial basics (Section A) and, depending on ability and level of performance, one to 2 qualifications (Sections B and C) from the 9 modules offered. This is followed by the orientation and work-related internship.

Contents of the wage and salary specialist module

During your two-month training course to become a specialist in payroll accounting with Lexware/ DATEV at our Central German Institute, you will Important tax law and social security law content conveyed. This theoretical knowledge as well as Exercises on practical cases and the Working with accounting software should enable you at the end of the training to carry out correct wage and salary accounting in accordance with the latest legal status. The course follows a step-by-step structure.

Basics of payroll accounting

- Employment law

- payslip and payroll account

- tax deduction

- social insurance

- Determination of statutory deductions

- special billing groups

Advanced level wage and salary accounting

- special salary components/personnel expenses and their determinants

- Forms of remuneration/wages

- surcharges

- special services

- ongoing and one-time payments, special payments

- Company pension plan

- Traveling expenses

Lexware/DATEV wage and salary accounting

- Creation of personnel master data

- marginal/short-term employment

- Data for social security registration

- Record illness/holiday

- Enter and bill payroll data

Learn more about Lexware

Lexware includes various commercial software packages, which is aimed specifically at the self-employed, freelancers and small and medium-sized companies. Their areas of application are diverse. There are special programs for merchandise management, human resources, absenteeism and wage information, travel expenses, accounting, real estate, tax returns and even for craftsmen. With the help of Lexware, many commercial tasks can be implemented digitally and efficiently. Depending on which range of services is selected, the software includes, among other things, functions to Making bookings, writing invoices, processing orders, calculating wages and salaries and coordinating appointments.

More information about DATEV

DATEV is an abbreviation for data processing organization. This is a registered cooperative that represents the interests of its numerous members. The members of the cooperative who have to work as tax consultants, auditors or lawyers are diverse software solutions and IT services provides. DATEV includes various application packages and is used in different business areas: among others in the Accounting, taxation, in human resources management, office organization and business consulting, but also in the area Further Training and Consulting. The programs are used by both large and medium-sized companies. The core areas of application are the electronic accounting and payroll accounting. More than 200 software solutions are available to members for this purpose. In addition, the various software packages for financial accounting also contain solutions for order management, payment transactions and document storage.

Benefits of the wage and salary specialist module

We from Central German Institute strive to provide you with comprehensive support during your further training and to prepare you optimally for your new career. For this reason, we provide you with the best possible learning and working conditions as well as a wide range of additional and support offers from which you can only benefit.

Comprehensive support ✓

Even before you start the course, we are there for you and will advise you in detail on our modular training options. With our information meetings, we would like to help you to find the further training path that best suits your interests and goals.

Modular qualification in the commercial area ✓

Thanks to the modular structure, it is possible to specifically select the courses that you need in order to obtain a commercial qualification that matches your prior knowledge. In addition, you have the opportunity to acquire a qualified qualification as a specialist or as a specialist or commercial assistant in a specific economic area in our certified training courses.

On-site lessons: Learn at your own pace with personal supervision ✓

During the duration of the measure, our competent employees will be at your side as direct contacts. The personal on-site lessons have the advantage that you can contact our specialist lecturers, work educators and business economists immediately to clarify questions and clear up any misunderstandings. In this way, we guarantee you individual support and fast and efficient learning.

Best learning conditions for optimal success ✓

A pleasant working atmosphere awaits you in our technically modern training facility, which should motivate you to achieve the best possible learning success. The teaching of actionable and practical course content prepares you optimally for your career start in the commercial and business administration area.

Funding Opportunities

Since this training measure is aimed specifically at customers of Deutsche Rentenversicherung who are interested and oriented towards business, our commercial modular qualification can also be funded by this cost bearer.

Summary

Of course Specialist for wage and salary accounting with Lexware/DATEV is one of the specialist modules of the commercial modular qualification, in which you can acquire a qualified qualification as a specialist. This module gives you the opportunity to gain an important additional qualification in the field of accounting, which you can use to increase your potential on the job market. However, basic knowledge of business accounting is a prerequisite for participation in the training course to become a specialist in payroll accounting. If you don't have this prior knowledge, that's not a problem either. The modular structure of the KMQ makes it possible to catch up on the necessary basic knowledge by booking other modules. During the course you will be trained in the basics as well as in the development and application knowledge of wage and salary accounting. Knowledge is imparted by means of exercises in practical cases and the use of accounting software (Lexware and DATEV). Through hands-on and practical learning, important key skills in the economic area of payroll accounting can be imparted to you. In this way you can increase your potential on the job market and prepare yourself in the best possible way for your commercial career.

Would you like to find out more about our commercial courses and find out which course best suits you and your interests? We will advise you personally! Regardless of whether you want to continue your education, change your career direction or get back into your old job, we will support you on your career path and find a measure that optimally suits your plans. Simply get in touch using our inquiry form and by telephone on 0800 77 89 100.

Would you like to find out more about our commercial retraining and further education offers? Then get in touch with us! You can reach us online using our contact form or by phone on 0800 77 89 100. We will be happy to advise you and work with you to find a measure that suits you and your interests!

Did you find this article helpful and would you like to be informed about all current measures and events at the MIQR? Then follow us on our official MIQR Facebook page and subscribe now "I like it".

Also interesting:

In addition to the commercial modular qualification, we at the Mitteldeutsches Institut also have other commercial training measures on offer. Our catalog of measures also includes the courses:

Course Information

| Duration: | 9 months (Thuringia & Saxony) 12 months (Berlin) |

| Started: | regularly, by arrangement |

| Location and Measure number: (Stand 01 / 2022) | Berlin, Trachenbergring: R70-0139-21 Berlin, Prenzlau Promenade: R70-0215-21 Chemnitz: R70-0176-20 Dresden: R70-0177-20 Erfurt: R70-0174-20 Leipzig: R70-0178-20 Suhl: R70-0175-20 |

| Form of teaching: | personal training (group/frontal lessons) + company internships |

| KMQ information material as PDF | |

| Verifiable via: | |

| German Federal Pension Insurance, Central Germany & Knappschaft Bahn See |

If you have any questions about our offer or would like personal and individual advice, please send us an inquiry.